Navigating Market Turmoil: What Happens If There Is a Recession? (Part 3)

As global markets grapple with volatility, retirees and pre-retirees are understandably concerned about the possibility of a recession. In the third part of our four-part series, we address: What happens if there is a recession? This newsletter offers general insights to help you understand the implications, without providing personal financial advice.

What Is a Recession?

A recession is typically defined as two consecutive quarters of negative GDP growth, often accompanied by rising unemployment, reduced consumer spending, and declining corporate profits. Current fears of a recession stem from:

High Interest Rates: Central banks, including the Reserve Bank of Australia, have raised rates to curb inflation, slowing economic activity.

Global Slowdown: Weak growth in major economies like China and Europe has dampened demand.

Cost-of-Living Pressures: Inflation has strained household budgets, reducing consumption.

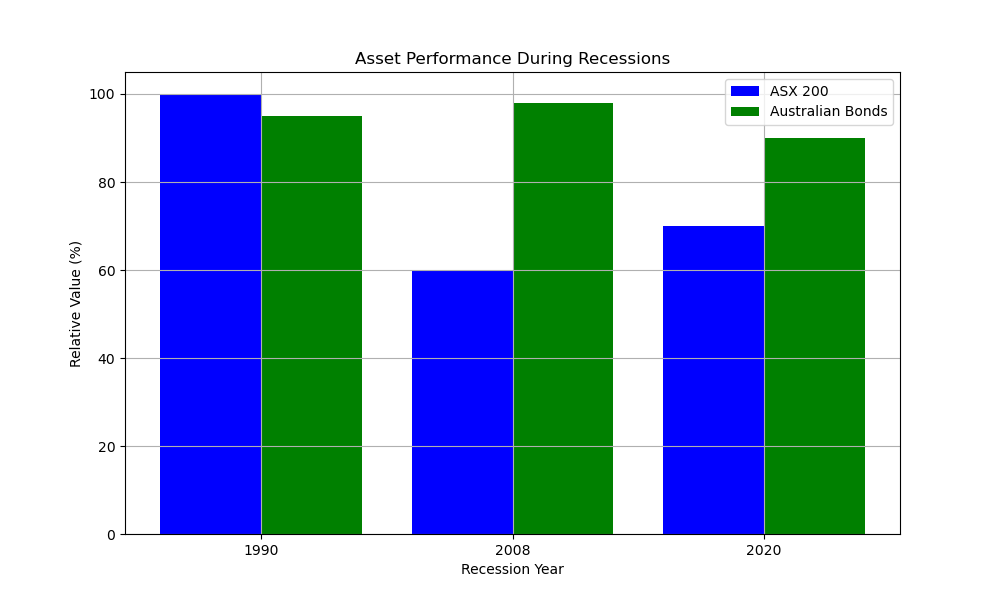

The graph below compares the performance of Australian equities (ASX 200) and bonds during past recessions, illustrating how different assets respond.

Graph: ASX 200 vs. Australian Government Bonds during recessions (1990, 2008, 2020). Data source: Reserve Bank of Australia (2025).

During the 2008 Global Financial Crisis, the ASX 200 fell by over 40%, while bonds provided relative stability. In contrast, the 2020 recession saw a swift equity recovery due to government stimulus.

Implications for Investors

Recessions can impact portfolios differently, depending on asset allocation and personal circumstances:

Equities: Stocks often decline as corporate earnings weaken, though defensive sectors (e.g., utilities, healthcare) may outperform.

Bonds: High-quality government bonds typically offer stability, though rising yields can pressure bond prices.

Income Needs: Retirees relying on dividends or withdrawals may face challenges if markets fall, highlighting the importance of liquidity.

For retirees, a recession may raise concerns about portfolio longevity, while pre-retirees might see opportunities to invest at lower valuations. Diversification, adequate cash reserves, and alignment with financial goals are key to weathering economic downturns (Reserve Bank of Australia, 2024).

A financial planner can help stress-test your portfolio against recession scenarios and ensure it meets your income and risk requirements.

Final Thoughts

While recessions are challenging, they are a normal part of economic cycles. A well-structured portfolio can help mitigate risks and position you for recovery. In our final newsletter, we’ll tackle: Should we sell out now and see how things go?

For personalised guidance, consult a licensed financial planner.

References:

Reserve Bank of Australia. (2025). Financial Market Data. Retrieved from rba.gov.au.

Reserve Bank of Australia. (2024). Economic Outlook. Retrieved from rba.gov.au.

Disclaimer: This blog provides general information only and does not constitute financial advice. It has not taken into account your objectives, financial situation, or needs. Before making any financial decisions, you should consider whether the information is appropriate for your circumstances and seek advice from a licensed financial adviser. Past performance is not indicative of future results. Investments carry risks, including the potential loss of capital. Fitrio Wealth is an Authorised Representative (1234878) of Charter Financial Planning Limited; ABN 35 002 976 294, Australian Financial Services Licence Australian Financial Services Licensee and Australian Credit Licensee; Licensee No: 234665.