Navigating Market Turmoil: Do We Hold Any Gold? (Part 2)

In our second installment of this four-part series, we address another question on the minds of retirees and pre-retirees: Do we hold any gold? With global markets facing uncertainty, gold’s reputation as a “safe haven” asset has sparked renewed interest. This newsletter provides general insights to help you understand gold’s role in a portfolio, without offering personal financial advice.

Gold’s Role in Times of Uncertainty

Gold has long been valued for its ability to retain worth during economic instability. In 2024, gold prices rose significantly, driven by:

Inflation: Persistent inflation eroded purchasing power, prompting investors to seek assets that hedge against currency devaluation.

Geopolitical Tensions: Conflicts in Eastern Europe and the Middle East increased demand for safe-haven assets.

Central Bank Buying: Reserve banks, particularly in Asia, bolstered gold reserves, supporting price growth.

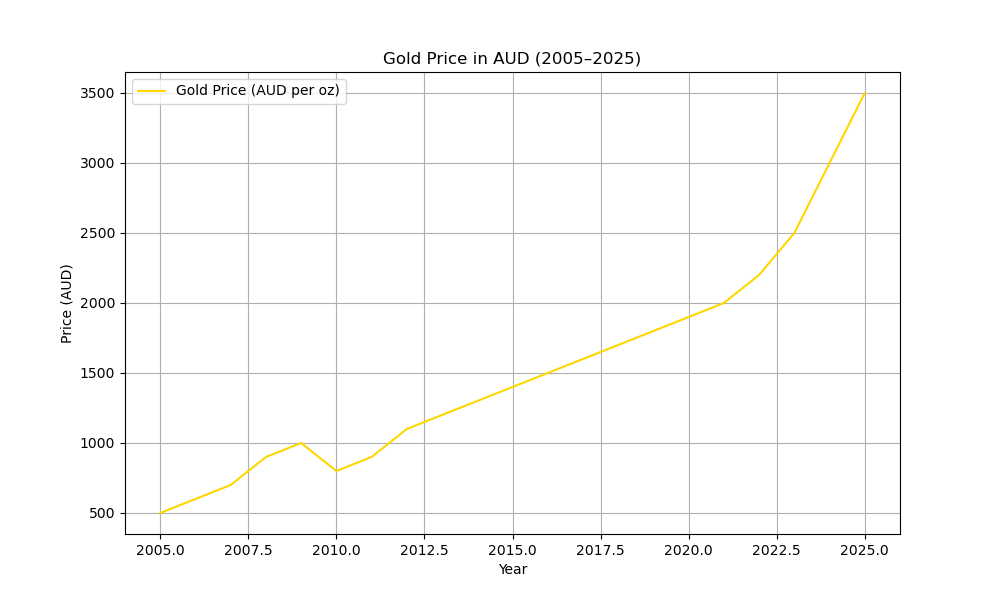

The graph below shows gold prices (in AUD) over the past 20 years, highlighting spikes during periods of crisis, such as 2008 and 2020.

Graph: Gold Price in AUD per ounce (2005–2025). Data source: World Gold Council (2025).

Gold’s price surged to over A$3,500 per ounce in late 2024, reflecting its appeal during turmoil. However, gold is not without risks—it generates no income (unlike dividends or interest) and can be volatile in the short term.

How Gold Fits in Portfolios

Whether your portfolio includes gold depends on your investment strategy. Common ways investors gain exposure include:

Physical Gold: Bullion or coins, often held for long-term security.

Gold ETFs: Exchange-traded funds tracking gold prices, offering liquidity and ease of access.

Gold Mining Stocks: Equities in gold mining companies, which may amplify gold price movements but carry company-specific risks.

Gold can diversify a portfolio, as it often moves independently of equities or bonds. However, its allocation varies widely—some portfolios hold 5–10% in gold, while others have none, depending on risk tolerance and goals (World Gold Council, 2024).

If you’re unsure about your portfolio’s exposure to gold, a financial planner can clarify whether you hold gold-related assets and whether they align with your objectives.

Final Thoughts

Gold can play a unique role in navigating market volatility, but it’s not a one-size-fits-all solution. Understanding its characteristics can help you make informed decisions. In our next newsletter, we’ll explore: What happens if there is a recession?

For tailored advice, consult a licensed financial planner.

References:

World Gold Council. (2025). Gold Price Data. Retrieved from gold.org.

World Gold Council. (2024). Gold as a Strategic Asset. Retrieved from gold.org.

Disclaimer: This blog provides general information only and does not constitute financial advice. It has not taken into account your objectives, financial situation, or needs. Before making any financial decisions, you should consider whether the information is appropriate for your circumstances and seek advice from a licensed financial adviser. Past performance is not indicative of future results. Investments carry risks, including the potential loss of capital. Fitrio Wealth is an Authorised Representative (1234878) of Charter Financial Planning Limited; ABN 35 002 976 294, Australian Financial Services Licence Australian Financial Services Licensee and Australian Credit Licensee; Licensee No: 234665 .